Luxury home buyers have more incentive to stay away from Toronto and look to Durham Region. The City of Toronto is at it again, with another jump in their Municipal Land Transfer Tax, which was voted into effect by council on December 17, 2025 and is effective on sales starting on April 1, 2026.

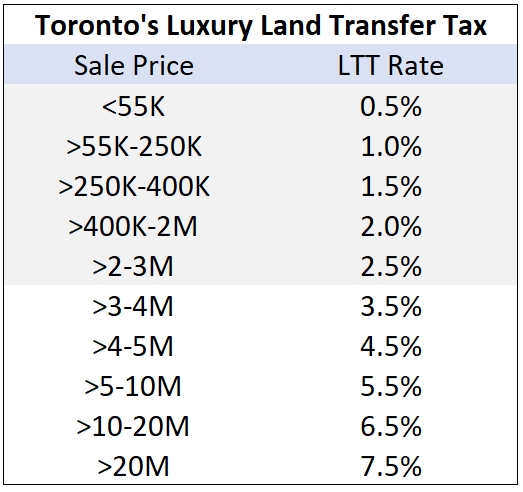

The following table outlines the new rates for residential properties sold in Toronto that contain 1 to 2 single-family residences:

Toronto Council votes to increase Municipal Land Transfer Tax for 2024

Toronto city council voted to increase their land transfer tax on properties selling for 3 million dollars and higher at a special session on Wednesday, September 6, 2023.

The new tax is set to start being taken starting January 1, 2024.

The new tax adds a further disincentive to luxury buyers who were already paying double the land transfer tax levied on transactions outside of Toronto.

With average property values for detached homes exceeding $2.5 million in Central Toronto, there were already substantial differences in neighbouring areas. Pickering, for example, had detached homes averaging just over $1.2 million in August. Average prices are even lower as you head further east.

Let’s look at the implications for buyers looking in the new ranges (existing shaded in gray):

For properties selling at 3,500,000, the current LTT payable outside Toronto is 66,475. In Toronto, it is currently 73,975 (plus the provincial 66,475). With the increase that will jump to 78,975 (+66,475).

It gets progressively more costly at higher price points. At 4,500,000, the Toronto LTT adds 118,975 in costs to the buyer. At 7.5 million it adds 278,975, and at 25 million a whopping 1,441,475 in extra LTT versus elsewhere in Ontario.

To look at the new tax, view my Land Transfer Tax Calculator.

Of course, you could argue that those who can afford properties at these price points can afford the extra tax. On the other hand, you can look at the combination of value and total costs of purchasing, which start to become very impactful as the selling price climbs.

For someone who doesn’t end up keeping a property for a long period, the implications of those extra land transfer taxes are very pronounced.

More Durham Region and Area Real Estate Articles

Ontario Property Tax Rates by Municipality 2025

Durham Region Market Report - December 2025

Property Tax Calculator for Durham Region

My other blogs contain market reports and information for the surrounding areas—see the menu for details.

About the Author

John Owen, Broker, REMAX Impact

John is an award-winning REMAX broker based in Courtice, ON, serving a wide area from east GTA to Northumberland.

Direct - 905-434-0067

Email - johnowen@remax.net

Member - REMAX Hall of Fame, Canadian Real Estate Association, Ontario Real Estate Association, Toronto Regional Real Estate Board.

Comments:

Post Your Comment: