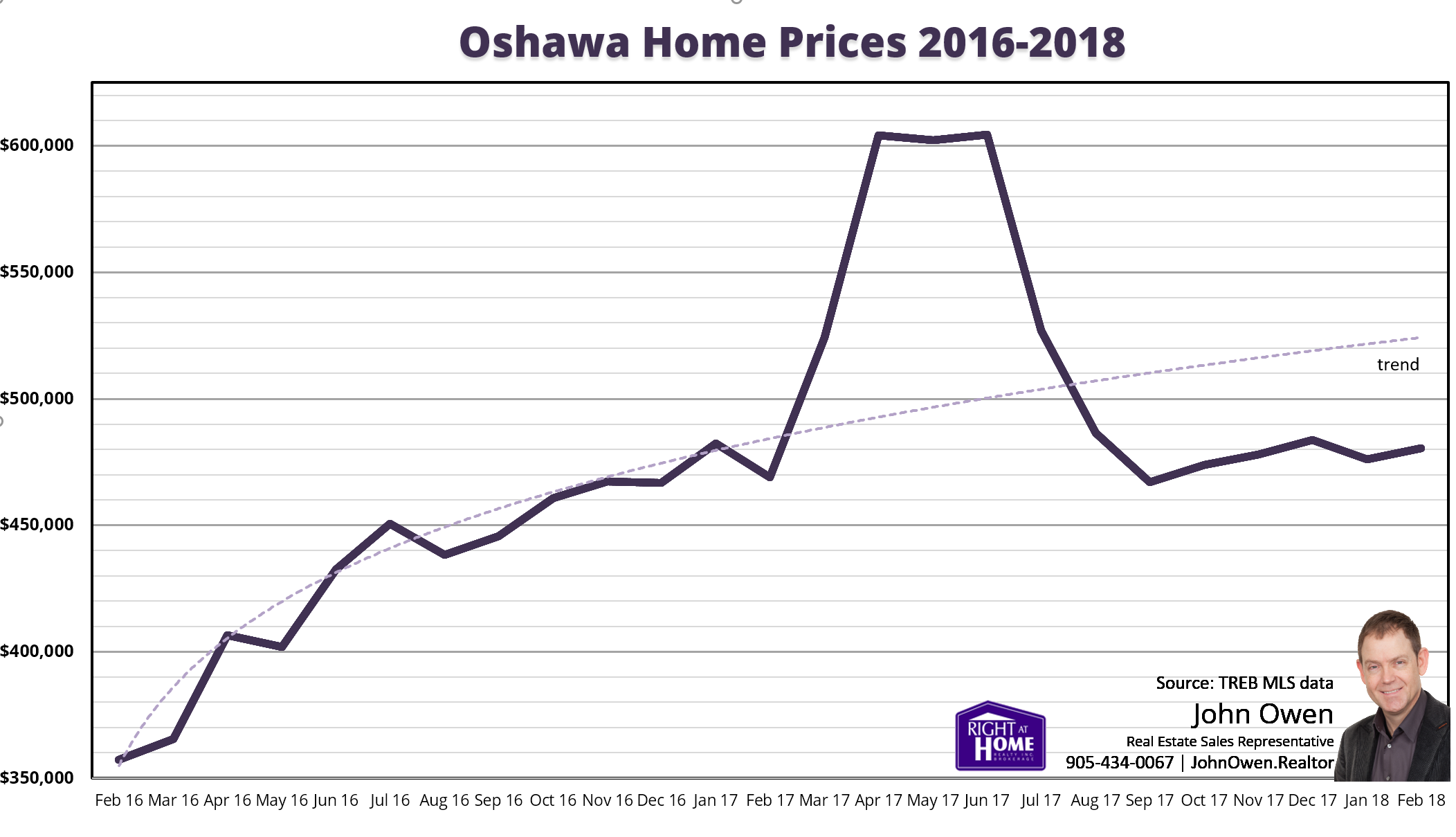

Oshawa's real estate market has improved for both sellers and buyers in February 2018. Prices are trending up over January, and there is more inventory for buyers.

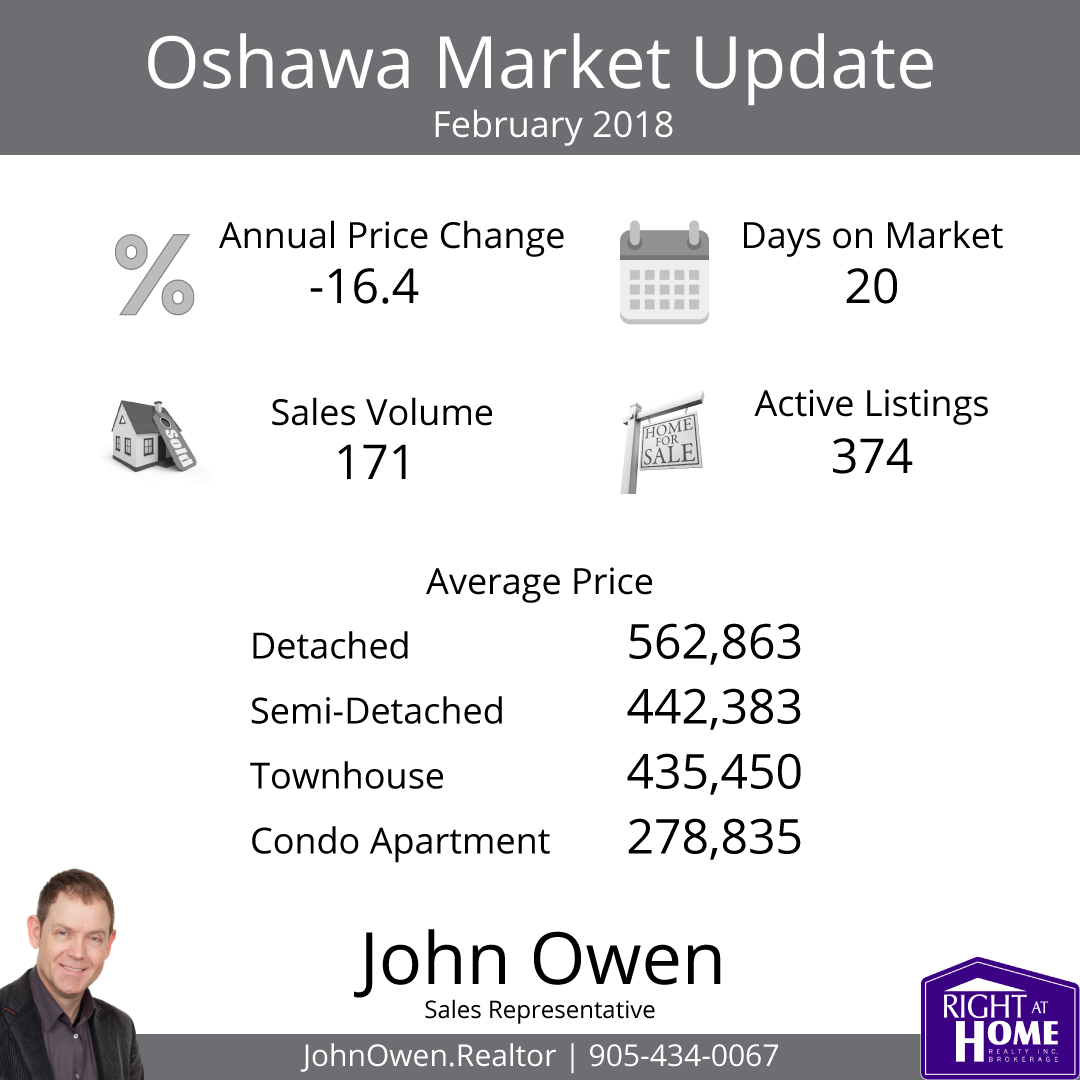

Oshawa prices dropped 16.4% compared to February of 2017, but they increased 1.9% over January 2018 levels. Making comparisons to last year isn't reflective of a typical sales cycle, however, as prices, volume and days on market were all well off norms through spring of last year.

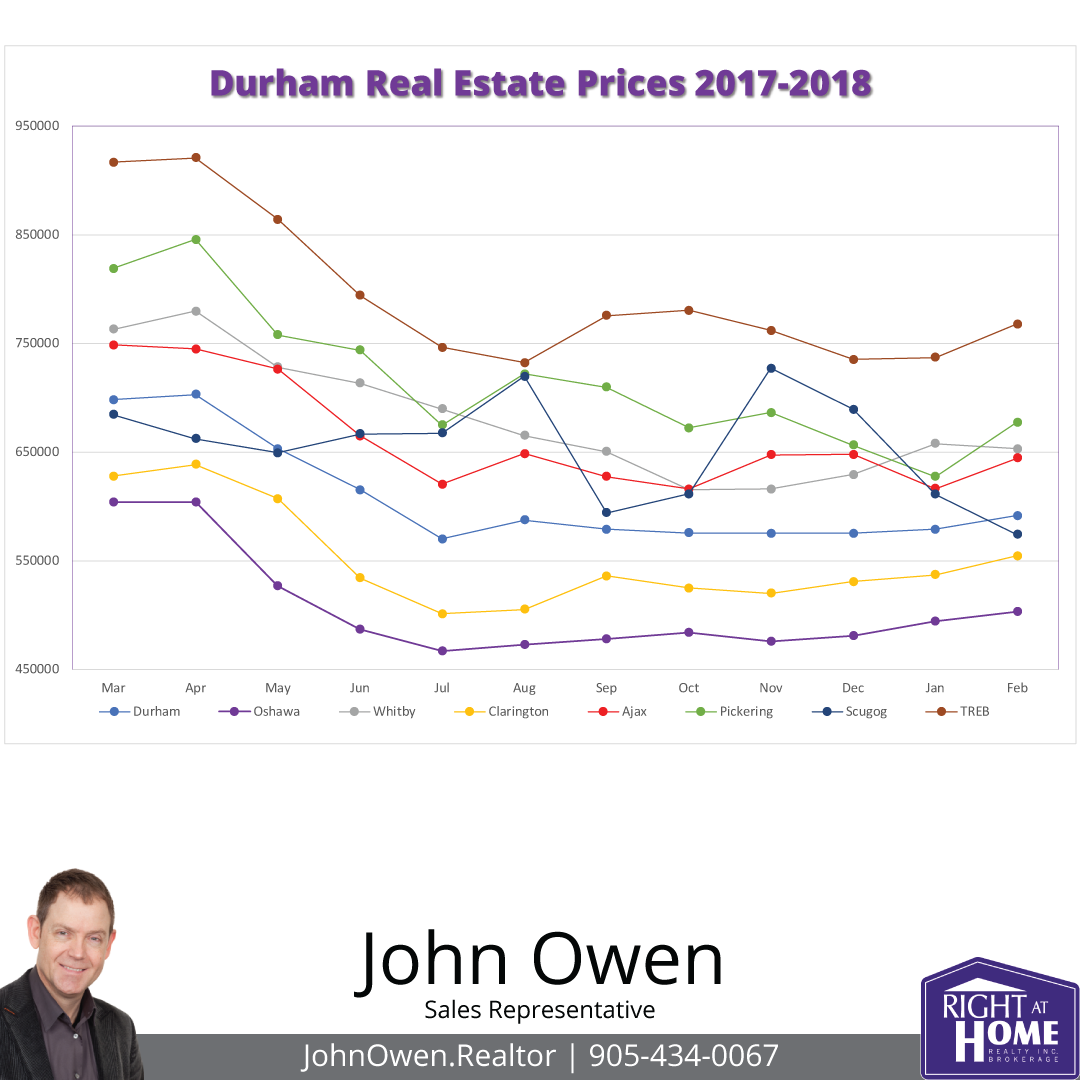

Average prices for all of TREB are still higher than August's low, as shown in the following chart (burgundy line), though the numbers since October are following a more typical price trend that we saw in the previous year (as prices were mostly rising regardless of season). Most of the areas in Durham Region (blue line) and Oshawa (purple) have increased since their low point in July, with varying performance since then.

Oshawa is at a high point since it's July low, showing good price performance compared to most GTA cities over the same period.

The Toronto Real Estate Board's (TREB) latest market statistics show the average Oshawa property at $503,123 - up from last month's 493,888 by $9,235.

Sales volume fell 26.6% with 171 units sold versus 233 last February, but well up from last month, when there were 137 transactions.

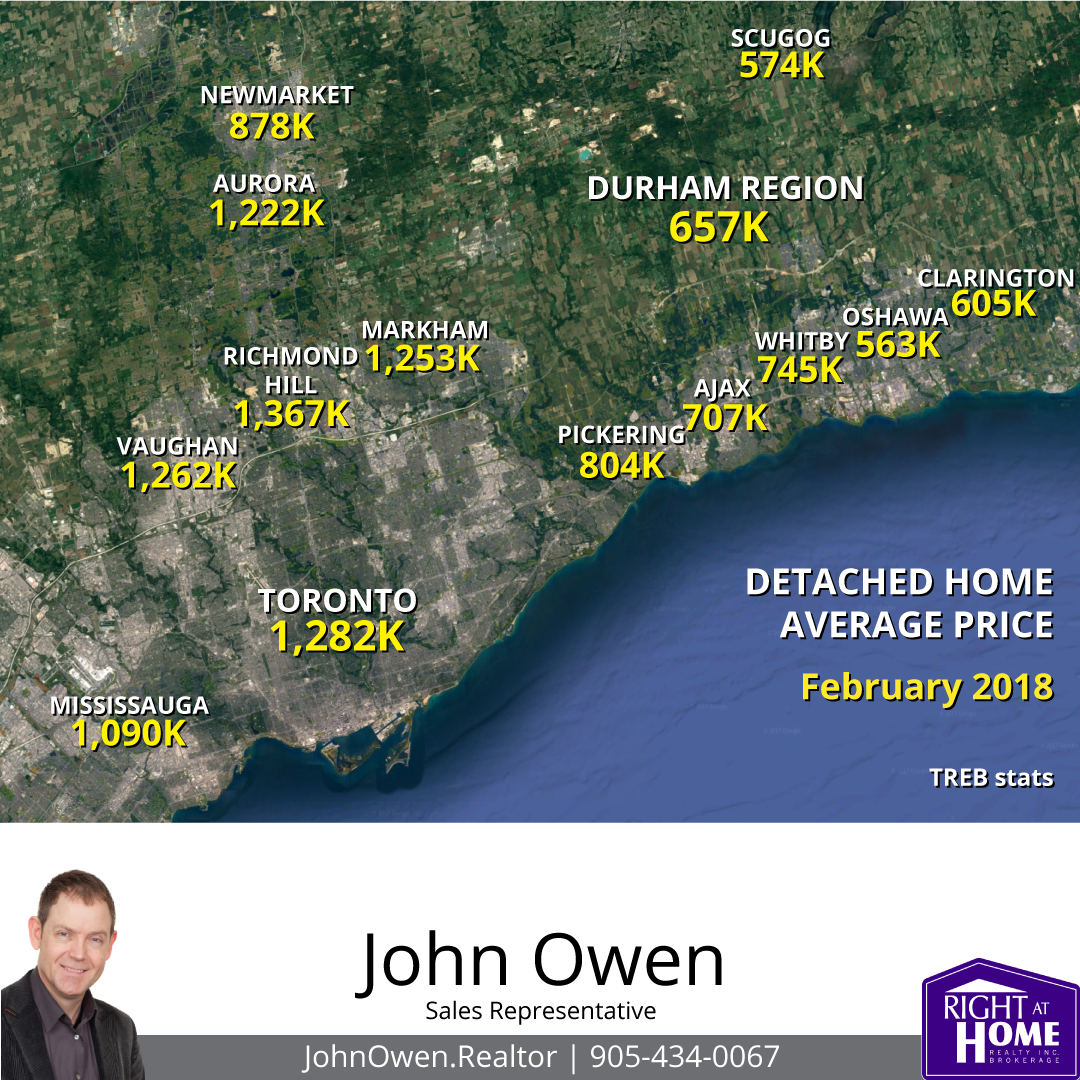

The average selling price of homes in the GTA this February was $767,818. This represents a 12.3% decrease since February 2017. Sales volume was down 35.4%.

The difference between TREB overall and Oshawa suggests that buyers seeking value are looking, and buying, in Oshawa over other areas that are seeing dips in volume and price.

Inventory - Balance Brings Back Negotiating

Active listings within the board increased 147.4%, which shows a shift in market fundamentals. The jump in inventory is helping to make the market more balanced - more inventory means less bidding wars as supply rises.

In Oshawa, the increase was 289.6% with 374 active listings over just 96 last year. This helps to explain why prices dropped from last year's levels.

The increase still isn't enough to make it a buyer's market, though. The average property in Oshawa still sold for 99% of asking. That's still close to being on par with the entire GTA, and is partly due to Oshawa still having the lowest average prices in the market.

The current trend shows only 1.8 months of inventory.

What are homes selling for in Oshawa?

The MLS Home Price Index helps to normalize the statistics, by adjusting sales statistics to represent typical homes within MLS areas. When using these numbers, Oshawa showed a composite annual gain of 2.74%, compared to the TREB average of 3.21%.

Inventory levels continue at moderate levels with 2.1 months of inventory on hand across the board. This means that a current sales levels, all of the property would be bought up in the GTA in 2.1 months (if no new listings were added). In Oshawa, there is 1.8 months inventory.

The average listing in Oshawa spent 20 days on the market. The TREB average was 22 days.

If you are interested in seeing values for an area not shown, or are interested in other figures, please comment below or send me an email - John@JohnOwen.Realtor As always, give me a call anytime if you would like to discuss further without any obligation.

Older Reports

Member, Canadian Real Estate Association (CREA), Ontario Real Estate Association (OREA), Toronto Real Estate Board (TREB).

Comments:

Post Your Comment: