Compare Durham Region and GTA Property Tax Rates

Last updated December 10, 2025

Property taxes vary significantly between municipalities in Durham Region and the GTA.

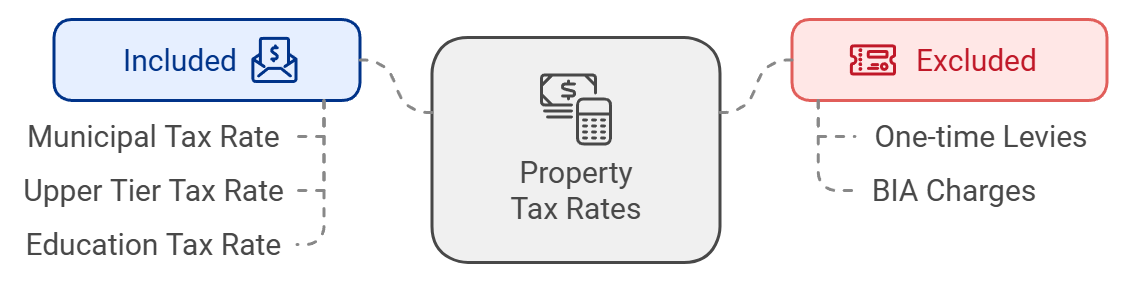

This article explores rates including the following:

Municipal tax rate

Upper tier municipality tax rate (county or region)

Education tax rate

It does not include other considerations, including these:

One-time levies

BIA charges

We include only the basics to provide a common baseline for comparison. There may also be minor differences between neighbourhoods in a given city. In those cases, we take the highest rate provided.

Durham Region Property Tax Rates 2025

GTA Property Tax Rates 2025

Q. Who has the highest property tax rates in the GTA?

A. Oshawa has the highest property tax rate in the Greater Toronto Area for 2025 at 1.524475%

Q. Who has the lowest property tax rates in the GTA?

A. Markham has the lowest property tax rate in the Greater Toronto Area for 2025 at 0.700278%

Durham Region Property Tax Increases for 2026

The Regional Municipality of Durham has proposed a huge 6.04% tax increase for 2026. It has since been amended to a 3.0% increase.

The City of Oshawa has proposed a 4.68% tax increase for 2026.

Whitby has proposed a 3.49% property tax increase for 2026.

Clarington has approved a 3.00% property tax hike for 2026.

Ajax has finalized it’s 2026 budget with a 1.28% increase for 2026.

Related articles:

Ontario Property Taxes by City 2025

Property Tax Calculator - Durham Region

Why are Property Tax Rates so High in Oshawa?

About the Author

John Owen, Broker, RE/MAX Impact

John is an award-winning RE/MAX broker based in Courtice, ON and serving a wide area from east GTA to Northumberland.

Direct - 905-434-0067

Email - johnowen.realtor@gmail.com

Member - RE/MAX Hall of Fame, Canadian Real Estate Association, Ontario Real Estate Association, Toronto Regional Real Estate Board.

Comments:

Post Your Comment: