Whitby's real estate market for residential properties surged forward this March with an average price increase of 40.9% over March of last year. The Toronto Real Estate Board's (TREB) latest market stats put the average property selling at $762,786- up from last year's 541,397.

The average selling price of homes in the GTA this March was $916,567. This represents a 33.2% increase over 2016. Sales volume rose 17.7% and new listings increased 15.2% from last year.

Active listings were down sharply - 35.2%, which shows that new listings weren't enough to counter a tremendously strained inventory that makes for incredible demand on the listings out there and resulting in bidding wars galore on well-prepared and marketed properties.

The MLS Home Price Index helps to normalize the statistics, by adjusting sales statistics to represent typical homes within MLS areas. When using these numbers, Whitby showed a composite annual gain of 34.86%, compared to the TREB average of 28.59%.

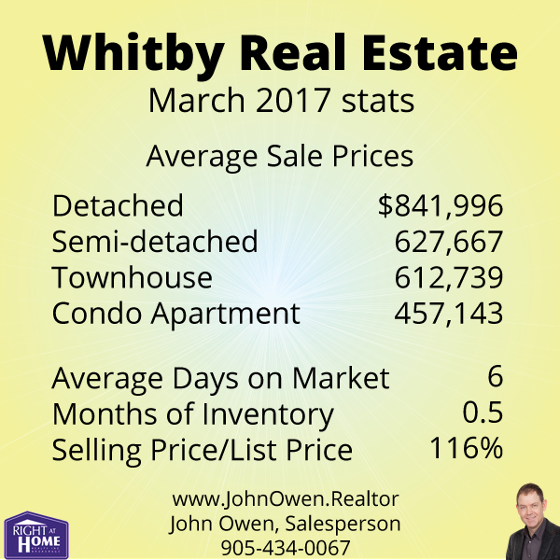

Inventory levels continue at very low levels with 1.0 months of inventory on hand across the board. This means that a current sales levels, all of the property would be bought up in the GTA in 1.0 months (if no new listings were added). Many areas within the GTA have similar figures, but unsurprisingly to those who read my reports, Durham Region still has the lowest inventory in the entire area. Overall, there is only 0.6 months inventory in the area. In Whitby, there is just 0.5 months inventory. Many home prices and types are experiencing bidding wars.

The average listing in Whitby spent 7 days on the market. The TREB average was 10 days.

The average listing sold for 116% of asking, again demonstrating that demand is very strong, and a clear indication of multiple offers on many listings.

If you are interested in seeing values for an area not shown, or are interested in other figures, please comment below or send me an email - John@JohnOwen.Realtor As always, give me a call anytime if you would like to discuss further without any obligation.

Older Reports

Member, Canadian Real Estate Association (CREA), Ontario Real Estate Association (OREA), Toronto Real Estate Board (TREB).

Comments:

Post Your Comment: